up to 8,500% return in 5 years! Investors made a killing in these 30 smallcap stocks

- Get link

- X

- Other Apps

U

By Rahul Oberoi, ETMarkets.com | Updated: Dec 01, 2017, 04.06 PM IST

Post a Comment

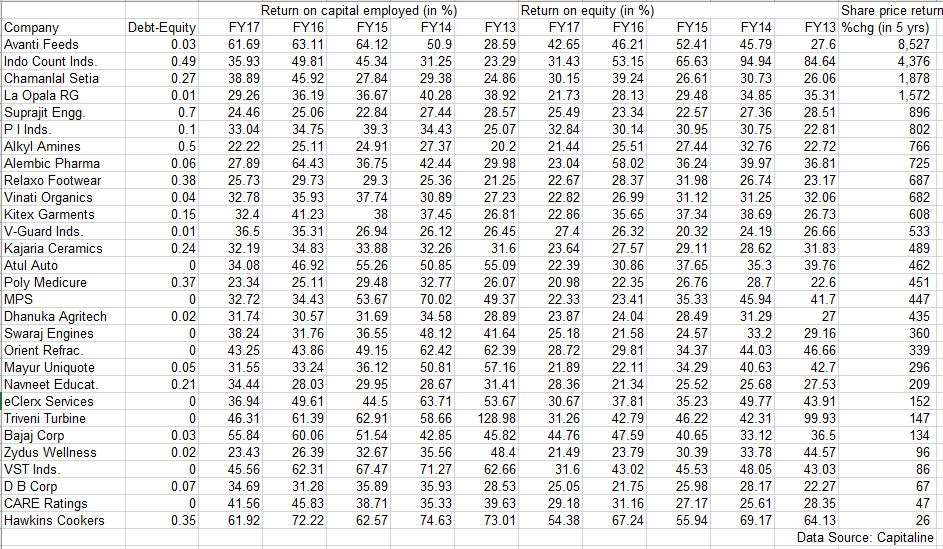

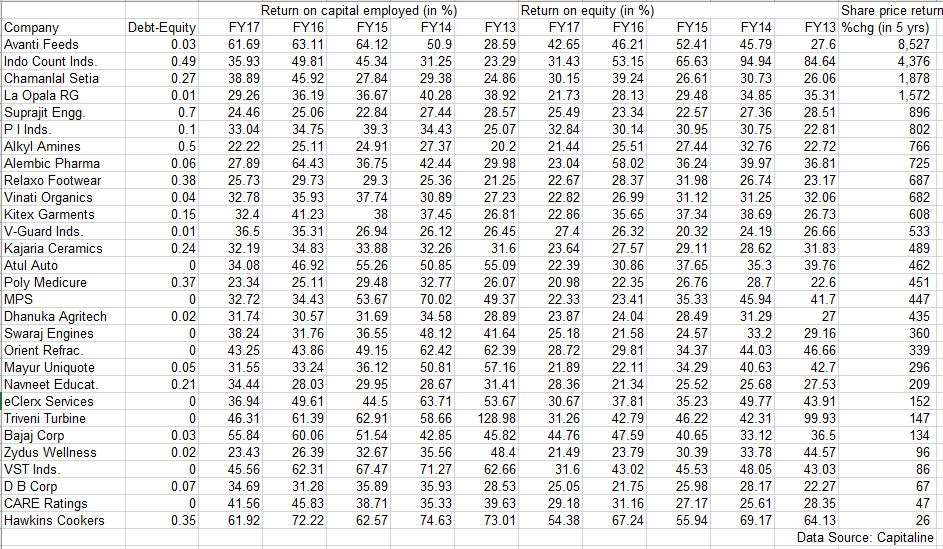

Efficiency pays in the long run. Among the top smallcap plays on Dalal Street, 30 companies with stable return on equity (RoE) and return on capital employed (RoCE) have surged up to 8,500 per cent over the past five years.

All these companies had a debt-to-equity ratio of less than 1 and have been maintaining RoE and RoCE of over 20 per cent since 2012-13.

Avanti Feeds emerged the chart topper, with an 8,527 per cent gain to Rs 2,596.60 as of November 28 from Rs 30.10 ..

Market mavens say the current financial year has proven to be a great one for Avanti Feeds so far, both in terms of sales and profitabilit ..

All these companies had a debt-to-equity ratio of less than 1 and have been maintaining RoE and RoCE of over 20 per cent since 2012-13.

Avanti Feeds emerged the chart topper, with an 8,527 per cent gain to Rs 2,596.60 as of November 28 from Rs 30.10 ..

ovember 28 from Rs 30.10 on November 27, 2012. The company’s return on equity for FY17, FY16, FY15, FY14 and FY13 stood at 42.65 per cent, 46.21 per cent, 52.41 per cent, 45.79 per cent and 27.60 per cent, respectively. Avanti also managed to achieve a return on capital employed of over 50 per cent in last four years. Its RoCE stood at 28.59 per cent inRoE measures net income earned for every rupee of shareholder funds, while RoCE is the measure of earnings before interest and taxes (EBIT) for every rupee of capital (equity and debt) employed in the company. So, RoE holds relevance for returns generated for equity shareholders while RoCE effectively measures the capital efficiency of a company.

Market mavens say the current financial year has proven to be a great one for Avanti Feeds so far, both in terms of sales and profitabilit ..

We remain bullish on Avanti’s medium- to long-term prospects,” Equirus Securities said in a research report. “But we remain watchful of raw material prices even though they remain benign as of now. We roll over to a March 2019 target price of Rs 2,950 based on 28X TTM EPS of Rs 105 (Dec 2018 target price of Rs 2,450 earlier),” it said.

Textile player Indo Count Industries and basmati rice manufacturer and exporter Chamanlal Setia advanced 4,376 per cent and 1,878 per cent, respectively, between November 2012 and this November. JM Financial has a ‘buy’ rating on Indo Count Industries with a target price of Rs 145. The scrip traded at Rs 122 on November 27.

“We believe softening of cotton prices is likely to provide some relief to Indo Count going forward. The volume offtake in the seasonally strong second half rema ..

“We believe softening of cotton prices is likely to provide some relief to Indo Count going forward. The volume offtake in the seasonally strong second half rema ..

ther stocks on the list included La Opala RG (up 1,572 per cent), Suprajit Engineering (up 896 per cent), PI Industries (up 802 per cent), Alkyl Amines (up 766 per cent) and Alembic Pharma (up 725 per cent).

Edelweiss Securities is positive on Suprajit Engineering with a target price of Rs 324, while JM Financial believes Alembic Pharma can touch Rs 630 by December 2018.

Yes Securities is positive on La Opala RG with a target price of Rs 640. Over the past five years, ..

Edelweiss Securities is positive on Suprajit Engineering with a target price of Rs 324, while JM Financial believes Alembic Pharma can touch Rs 630 by December 2018.

Yes Securities is positive on La Opala RG with a target price of Rs 640. Over the past five years, ..

mong others, shares of Relaxo Footwear, Vinati Organics, Kitex Garments, V-Guard Industries, Kajaria Ceramics, Atul Auto, Poly Medicure, MPS and Dhanuka Agritech gained 687 per cent, 682 per cent, 608 per cent, 533 per cent, 489 per cent, 462 per cent, 451 per cent, 447 per cent and 435 per cent, respectively.

Relaxo Footwears registered strong performance in Q2 of FY2018 with revenue and net profit growing in double digits. There are expectations that the goods and services tax (G .. mong others, shares of Relaxo Footwear, Vinati Organics, Kitex Garments, V-Guard Industries, Kajaria Ceramics, Atul Auto, Poly Medicure, MPS and Dhanuka Agritech gained 687 per cent, 682 per cent, 608 per cent, 533 per cent, 489 per cent, 462 per cent, 451 per cent, 447 per cent and 435 per cent, respectively.

Relaxo Footwears registered strong performance in Q2 of FY2018 with revenue and net profit growing in double digits. There are expectations that the goods and services tax (G ..

Relaxo Footwears registered strong performance in Q2 of FY2018 with revenue and net profit growing in double digits. There are expectations that the goods and services tax (G .. mong others, shares of Relaxo Footwear, Vinati Organics, Kitex Garments, V-Guard Industries, Kajaria Ceramics, Atul Auto, Poly Medicure, MPS and Dhanuka Agritech gained 687 per cent, 682 per cent, 608 per cent, 533 per cent, 489 per cent, 462 per cent, 451 per cent, 447 per cent and 435 per cent, respectively.

Relaxo Footwears registered strong performance in Q2 of FY2018 with revenue and net profit growing in double digits. There are expectations that the goods and services tax (G ..

Shares of Swaraj Engines, Orient Refractories, Mayur Uniquoters, Navneet Education, eClerx Services, Triveni Turbine, Bajaj Corp, Zydus Wellness, VST Industries, DB Corp, Care Ratings and Hawkin Cookers climbed between 25 per cent to 360 per cent in last five years.

Equirus Securities recently revised its target price for Mayur Uniquoters from Rs 460 for September 2018 to Rs 505 for Marc ..

Equirus Securities recently revised its target price for Mayur Uniquoters from Rs 460 for September 2018 to Rs 505 for Marc ..

- Get link

- X

- Other Apps