LIC accumulates stake in 22 Sensex cos

Bureau

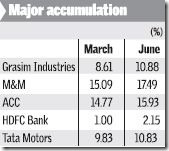

Mumbai, July 25 Life Insurance Corporation of India (LIC) appears to have made some value buying in the last quarter, when many blue chips lost heavily from bear hammering.

The Government-owned insurance company, which is a major player in the equity market, increased its stake in the Sensex stocks during April-June quarter

LIC raised its stake in 22 Sensex companies, during the June quarter, according to a study on the Sensex companies’ public shareholding of more than 1 per cent.

Prunes stake

However, it pruned or maintained its stake in the IT software majors during the same period; software companies’ share prices outperformed the Sensex during the last quarter. On a quarter-to-quarter basis, during the same period, the Sensex fell 14 per cent, to 13,461 on June 30 from 15,644 at March end.

It reduced its stake in Infosys from 3.72 per cent to 3.62 per cent and in Satyam Computer it brought down its stake from 2.71 per cent to 2.51 per cent.

In TCS, while the LIC stake remains unchanged at 2.21 per cent, Wipro’s shareholding pattern for June quarter has not been updated.

Its stake in Housing Development and Finance Company also remains unchanged at 1.43 per cent. In Ranbaxy Laboratories, LIC reduced its stake from 15.84 per cent to 15.01 per cent.

ICICI Pru too hikes

The private sector ICICI Prudential Life Insurance has also been strengthening its stake in the Sensex companies. In the June quarter, ICICI Prudential raised its stake in Infosys to more than 1 per cent during the quarter, whereas in the previous quarter, it did not figure in the one per cent plus shareholder list.

Among other companies in which ICICI Prudential Life Insurance has raised stake in the June quarter are ACC (from 1.10 per cent to 1.13 per cent), HDFC Bank (more than 1 per cent to 2.65 per cent), Satyam Computer (from 2.83 per cent to 3.28 per cent), Mahindra & Mahindra (from 3.18 per cent to 3.42 per cent). Meanwhile, in same quarter, ICICI Prudential reduced its stake in capital goods major Larsen & Toubro (from 1.38 per cent to 1.33 per cent) and in BHEL it reduced (from 1.45 per cent to 1.17 per cent).

Barring UTI, most of the domestic mutual funds don’t figure among the public shareholders having more than one per cent stake in the Sensex companies.

The FIIs during the same period showed mixed behaviour. Many FIIs raised their stake in Sensex companies, but those who have reduced their stake or made a complete exit outnumber the former.

In DLF and NTPC neither LIC nor any other public shareholder had 1 per cent or more stake as at the end of the last quarter.